All Time High Ahoy

The Sensex has recently breached 67500, marking an all-time high, and similar highs have been observed for Nifty as well in the past 3 months. After hovering around 60000 for 3 months earlier this year and hitting 57500 on 15 th Mar 2023, it has zoomed to 67500 on 20 th July 2023. roughly 17 % growth in 4 months.

Let’s refrain from delving into the reasons behind the occurrence of all-time highs and the timing of such events. Numerous commentaries attempt to explain them in retrospect, but it’s important to note that these explanations were not predicted before the events took place. Some of these explanations are purely retrospective, as it proves challenging to anticipate such market movements in advance.

When the Sensex hits lows, it instigates anxiety and gives rise to various issues. The accompanying prognosis and commentary often reflect a sense of pessimism, regardless of the underlying reasons. On the other hand, when the Sensex reaches an all-time high, it creates uncertainty, leaving investors pondering what actions they should take. In this article, we aim to address the different dilemmas faced by investors when the Sensex consistently breaches all-time highs in a short time span. Our goal is to dispel some common misconceptions surrounding these market movements.

Common Facts about All Time Highs

1. All-Time Highs are Routine:

In a growing economy like India, which is expected to reach the 5 trillion mark in the future, constant breaches of all-time highs are to be anticipated. The upward trajectory of Sensex reflects India’s favorable demographics, entrepreneurship, and democratic system. Although not a linear journey, Sensex is expected to reflect the underlying business growth of India by reaching new highs over the years.

2. Markets Worldwide Reach All-Time Highs:

The phenomenon of markets hitting all- time highs is not unique to Sensex alone. Capitalistic economies like the US and Europe also experience the same as they represent broader growth in companies participating in the global market. India is part of this global trend, making all-time highs a common occurrence.

3. No Law of Gravity in Markets:

The market does not follow the law of gravity, meaning it does not necessarily drop to lows after reaching all-time highs. Instead, it is more likely to continue its upward trajectory and create new all-time highs. Mean reversion is the observable pattern, where markets might revert back to fundamentals after running ahead or undervaluing, but there is no reason to fear an imminent crash.

What does a new investor do in All Time Highs?

As a new investor, your financial goals are likely far off, and the current all-time high is just a part of your investment journey. Determine your risk appetite and choose an appropriate equity and bond mix. You can start investing right away with the chosen mix. To provide some psychological comfort, consider using Systematic Investment Plans (SIPs). A combination of hybrid funds and SIPs is recommended for first-time investors, as hybrids adjust the allocation of equity and debt based on market conditions. Our article on Hybrids for First time investors covers some key advantages in going with this approach.

What does an experienced investor do in All Time Highs?

Experienced investors, who have likely experienced market highs and lows, should continue investing according to their targeted portfolio allocation ratio. Additionally, they should periodically check their risk allocation, preferably not less than every 6 months, and consider portfolio rebalancing if necessary. Review our detail approach to Portfolio Rebalancing Process and ensure it is done during this market peak.

Hybrid funds can be an excellent choice for experienced investors as well, as they automate the rebalancing process. So experienced or First-Time investors Hybrid funds are a great way to automate investments. As markets continue to hit new all time highs continue any of your existing investments via SIP – systematic investments which ensures cost average any immminent corrections preventing any anxiety of all time highs.

What about investors nearing their goal?

Investors nearing their financial goals should consider leveraging Systematic Withdrawal Plans (SWP) to gradually shift funds to liquid or debt funds if their goals are just a few years away.

As markets reach high levels it provides opportunity to draw some profits and fund the near term goals. SWP ensures automated withdrawals while preserving the opportunity for further market gains. The power and usage of SIP, SWP and STP is covered in detail for all scenarios including for market highs. Read them on and benefit from the power of automating your withdrawals as well as any fresh investments.

Time for Portfolio Remediation Actions

Market highs offer a chance to review and improve our investment decisions, enabling us to create a more robust and well-structured portfolio. As investors, our investment process has evolved over time, and some of our past choices might not have been well thought out. In hindsight, we may recognize the need to align our portfolio with the right ideal allocation.

Market highs present unique opportunities for remedial actions. For instance, if you had previously invested heavily in a sectoral fund or any other specific flavor of fund that has performed exceptionally well, you might consider reallocating to a more standard diversified portfolio. Making this change now is advantageous, as any potential regrets or losses would be minimal. It also allows you to strategically optimize your portfolio. Review the top mistakes in mutual fund portfolio construction and check for opportunities to optimise in market high.

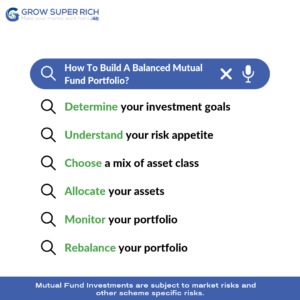

Additionally, it’s a favorable time to reassess individual stock investments or any unconventional ideas in your portfolio. Exiting from these positions and moving towards a well-diversified and balanced portfolio can provide a safer investment environment. Our guidance on building a balanced portfolio will help you in getting to a portfolio which you can stick to in market highs and lows.

Summary

Mastering the art of navigating all-time highs in the market demands a fundamental understanding of market dynamics and a clear vision of investment objectives.

1. Recognize that all-time highs are an integral part of a thriving economy like India’s.

2. As a new investor, don’t hesitate on the sidelines; instead, tailor your investment approach according to your risk appetite and dive right in. Embrace automation by leveraging SIPs and STPs to streamline your investing journey.

3. For experienced investors, maintaining the course is paramount. Engage in high-leverage activities like periodic portfolio assessments and strategic rebalancing to stay on track.

4. Embrace market highs as opportunities for refining your investment choices, crafting a meticulously diversified portfolio that aligns with your goals.

Disclaimer:

The information provided in this article is for educational purposes only and should not be considered as financial advice.

It is always recommended to consult with a qualified financial advisor before making any investment decisions.