A.Introduction:

In the dynamic world of freelancing and entrepreneurship, achieving financial stability and building long-term wealth requires a tailor-made approach.

The inconsistent cash flows associated with these professions demand an investment strategy that balances short-term needs with long-term goals.

Hence, it’s crucial to lay the groundwork by assessing financial goals, analyzing cash flows, and gauging risk appetite as we build the plans so the plans are sustainable over long run.

This article aims to address some aspects to consider while crafting a investment plan that addresses uneven cash and suggests some ways of securing financial future.

B. Investment Strategies for Freelancers and Entrepreneurs:

1. Setting up Emergency Fund:

This is most critical step. The emergency fund should be capable of covering six months’ worth of living expenses. This financial cushion acts as a core safety net during lean periods, addressing uneven cash flows and averting disruptions to long term plans and ensuring behavioral consistency.

2. Bond Ladder for Short-Term Buffer:

There is one more layer of short-term buffer that is needed for free lancers to address short-term expenses. Building a bond ladder spanning three years guarantees a consistent income stream for immediate financial needs, while safeguarding core capital. This also allows for long term investments time to grow allowing for some short term volatility.

3. Invest for growth:

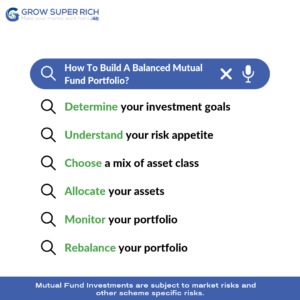

Despite fluctuating income, it’s imperative to maintain an investment approach with equity exposure. This equity exposure ensures that over time capital is built for long term expenses and grows to beat inflation. A balanced portfolio of equity and bonds serves as the cornerstone for building long-term wealth, capturing market growth potential while ensuring right level of risk. Read more about building a balanced portfolio here.

4. Hedging with Insurance:

After covering short term expenses via emergency fund and bond ladder and setting up a balanced portfolio for growth, the next step is hedging. In order to protect from severe impact but low probable events like health emergency from draining your funds there is need to adequately hedge them with right insurance coverage.

Adequate health insurance keeping in mind long term inflation of health costs is needed. A term life insurance coverage is imperative to ensure family is able to continue to maintain its lifestyle and goals despite unfortunate and untimely demise of breadwinner. Ensure that insurance is treated as insurance and not as investment.

Insurance offers protection against unforeseen medical expenses and uncertainties, ensuring the welfare of both your health and dependents over the course of your career.

5. Tapping into Guaranteed Options:

Considering the uncertain nature of cash flows some additional guarantees and options can be considered. One can think of sovereign-backed products like the Public Provident Fund (PPF) as additional investment options. These products offer higher stability but exercise prudence to retain flexibility in investment, preventing overcommitment to these investments considering long lock-ins.

6. Maximizing Tax Efficiency:

The National Pension System (NPS) is a tax-efficient tool for freelancers and entrepreneurs. It facilitates optimal equity and debt component allocation while conferring tax benefits and ability to rebalance without taxation. This is also one way of building one’s retirement and pension portfolio for old age.

C. Steps in Investment Journey

The following step wise approach will help in reducing the complexity and also assessing what kind of investments will suit the specific freelancer and entrepreneur.

1. Set Financial Goals:

Outline short-term and long-term financial objectives. This will help as guide throughout your investment process.

2. Decode Cash Flows:

Gain a understanding of your income patterns and fluctuations to shape a responsive investment strategy. Distinguish between regular and irregular income sources to understand the cash flow profile over seasons and years.

3. Risk Appetite:

Evaluate your comfort level with taking risk in investments and inherent volatility that accompanies higher returns. While variable incomes themselves might trigger risk aversion to volatility there is a broader risk of purchasing power getting eroded due to inflation. Considering both aspects need to choose a balanced approach to embrace risk judiciously to support both capital prevention and purchasing power protection.

4. Special Considerations:

Tailor your investment approach to suit your specific circumstances. If there are sporadic inflows followed by windfalls and subsequent lean periods, understanding these flows and even them out to maintain consistency of lifestyle and investment contributions. Beware of Lifestyle inflation during high income phase which will not be sustainable in lean phase.

4. Defining a Safe Savings Rate:

Determine the portion of income you can consistently save and invest. This ‘safe savings rate‘ acts as a compass, ensuring adherence during cash flow fluctuations.

5. Leveraging Mutual Fund Asset Allocation:

Harness the potential of mutual funds to achieve financial objectives. Implement a blend of equity and bond funds aligned with risk tolerance and investment horizon.

D. Cash Flow Management:

1. Flexible Budgeting:

Design a budget that accommodates both essential expenses and discretionary spending. Be ready to adapt during periods of low income, allocating funds based on priorities and necessities.

2. Building a Cash Reserve Buffer:

Beyond the emergency fund, maintain a dedicated cash reserve buffer. This resource can be tapped to cover anticipated income dips or seize unforeseen opportunities to invest.

3. Diversifying Income Streams:

Relying on a sole income source is risky. Explore diversification by offering various services, products, or part-time gigs related to your expertise, stabilizing income across different channels.

4. Strategic Invoicing:

Take control of payment timing through strategic invoicing. This approach ensures a steady cash flow, with incentives for early payment or partial upfront payments.

5. Effective Debt Management:

Leverage debt for growth when needed, but choose low-interest options. Manage repayments carefully to ensure feasibility during lean periods.

6. Proactive Tax Planning:

Allocate funds regularly for taxes to prevent surprises. Consider quarterly estimated tax payments for consistent compliance.

7. Lifestyle Prudence:

In prosperous times, avoid lifestyle inflation. Focus on saving and investing a larger portion of your income to create a financial cushion.

8. Regular Financial Check-Ins:

Periodically review your financial situation, adapting strategies as needed. Proactive management ensures readiness for changes in income.

9. Professional Financial Guidance:

Consult specialized financial advisors for tailored advice. Their expertise can design a plan that aligns with your unique circumstances and goals.

E. Conclusion:

Incorporating both investment strategies and additional best practices into your financial management approach creates a holistic framework for tackling the intricacies of freelancing and entrepreneurship.

Customize these practices to suit your situation, build your financial knowledge, and consider professional guidance to ensure you stay on course with your grow super rich goals.